Trading is a mindset

Albert Einstein said “The most important decision we make is whether we believe we live in a friendly or IN A hostile universe”.

Your perspective of the world can make you or break as a trader!

How can we best serve you?

We share our technical analysis, to help your trading journey!

Weekly NOTES

sharing our notes for the week

technical analysis

review the LATEST analysis

trend notes

notes on the major trends for 2022

Never miss a thing!

Subscribe for OUR Newsletter and receive weekly analysis in your email box!

Weekly notes

The US Economy Between 1979-1983 and now: Inflation, Stock Market Volatility, and Rising Interest Rates

The period between 1979 and 1983 was marked by significant economic turbulence in the United States. Inflation rates were high, the stock market experienced volatility, and interest rates were on the rise. Here are some key facts and figures from that era: Inflation: In 1979, the US inflation rate peaked at around 13.3%, the highest level…

Central banks rate hikes cycle, turning into currencies war

Last week three central banks raised their interest rates, two of which surprised the markets. The Federal Reserve of the United States increased its interest rate by 0.75%, vs. an expectation of a 0.50% hike. The Switzerland National Bank (SNB) raised its rate by 0.50%, from the previous -0.75% to -0.25%, which was a total…

Continue Reading Central banks rate hikes cycle, turning into currencies war

Is it 2018 again, or are we heading toward recession, maybe even worse, a stagnation

For the past month, we are witnessing many discussions, analyses, and opinions about the state of the economy in the US and the world. Many market and economic analyzers are comparing the current correction in the US stock market with the correction in 2018. In 2018 the FED chairman Powell started a series of interest…

The FED hiked the interest rates, and chairman Powell signaled another 0.50% rise in June

The Federal Reserve of the United States raised the interest rates in their meeting on the fourth of May 2022. During the Central Bank press conference, while answering questions, FED Chairman Powell implied, that another 0.50% hike is coming in June and perhaps in July, but ruled out a more aggressive hike of 0.75%. Many…

Currencies

USD/JPY Technical Analysis: Double Top Unveil Trends and Targets for Strategic Trading

In our USD/JPY technical analysis, a significant development unfolds as the pair forms double top on both the weekly and monthly charts, triggering a retracement. Delving into the intricacies, we explore key targets and potential scenarios for informed trading decisions. Bearish Momentum: Targets for Retracement Primary Target: 0.382 FIB Retracement (Weekly) – 142.45 The initial…

Deciphering NZD/USD Trends: Navigating Strong Resistance Zones

In our NZD/USD technical analysis, the currency pair encounters a formidable challenge as it grapples with a robust resistance zone. Delving into the technical intricacies, we explore key levels and potential scenarios for traders to consider. Facing Resistance: Weekly Chart Insights Primary Hurdle: Descending Trend Line and Monthly 50 EMA The NZD/USD pair finds itself…

Continue Reading Deciphering NZD/USD Trends: Navigating Strong Resistance Zones

EUR/USD Technical Analysis: Deciphering Trends and Targets for Strategic Trading

In our EUR/USD technical analysis, a pivotal moment unfolds as the pair rejects the 0.618 Fibonacci retracement with a high-test pattern on the monthly chart. Navigating through the long-term trend reveals a compelling narrative of bearish momentum and potential future targets. Bearish Momentum: Monthly Chart Insights Primary Bearish Target: 1.272 FIB Extension (Monthly) – 1.0420…

Continue Reading EUR/USD Technical Analysis: Deciphering Trends and Targets for Strategic Trading

Navigating Trends: Comprehensive Technical Analysis for GBP/USD

In our detailed GBP/USD technical analysis, the currency pair has recently encountered a critical juncture, marked by a rejection of the 0.618 Fibonacci retracement with a high-test candle on the monthly chart. Delving into the long-term perspective, our exploration of the monthly chart reveals a prevailing bearish trend that has staunchly rebuffed the 0.618 Fibonacci…

Continue Reading Navigating Trends: Comprehensive Technical Analysis for GBP/USD

Equities and Indexes

Navigating Opportunities: Comprehensive Technical Analysis of the Russell 2000 Index

Technical analysis reveals a bullish breakout in the daily chart for the Russell 2000 index. Breaking free from consolidation, the index initiates a bullish run, targeting key Fibonacci retracement levels and charting a course towards new heights. Bullish Breakout Unveiled: Targets and Trends Primary Target: 0.618 FIB Retracement on the Weekly Chart (2145) The initial…

Alphabet Inc (Google) Technical Analysis, the shares reached the third target of the bearish wave

Alphabet Inc (Google) technical analysis, as we pointed out in our previous analysis, the shares of Alphabet reached the third target of the bearish wave on the weekly chart, the 2.272 FIB extension at 84.30$, which was also a support zone and 0.618 FIB retracement on the monthly chart. The price bounced off that support…

NASDAQ TECHNICAL ANALYSIS, THE INDEX STARTED A PULLBACK ON THE WEEKLY CHART

Technical analysis for NASDAQ 100, the index reached the first target of the bearish wave on the weekly chart, the 1.272 FIB extension at 10 500, which is also a 0.618 FIB retracement on the weekly and monthly charts. The index bounced off that key level and broke above a descending trendline, starting a pullback on…

Continue Reading NASDAQ TECHNICAL ANALYSIS, THE INDEX STARTED A PULLBACK ON THE WEEKLY CHART

NVIDIA Technical analysis, the shares formed Head & Shoulders pattern

Technical analysis for Nvidia, the price of the shares reached the first target of the bearish wave on the weekly chart, the 1.272 FIB extension at 110.00$. Around that level, we had both horizontal and dynamic support on the weekly and daily charts. The bounce turned into a full breakout with a reversal Head &…

Continue Reading NVIDIA Technical analysis, the shares formed Head & Shoulders pattern

commodities

Gold Technical Analysis, the price rejected a resistance and started a pullback.

Gold Technical Analysis, the price formed a double bottom on the weekly chart, bounced from the 0.500 FIB retracement on the monthly chart at 1615$, and started a pullback. This pullback turned to a full breakout on the weekly and the daily chart, which sent the price of Gold soaring more than 20% higher. The…

Continue Reading Gold Technical Analysis, the price rejected a resistance and started a pullback.

Brent Oil Technical Analysis, the price is approaching 0.618 FIB retracement

Technical analysis for Brent Crude oil, the price is approaching the 0.618 FIB retracement on the weekly chart at 91.50$, which is the first target for the pullback. The second target for the pullback is the 0.382 FIB retracement on the monthly chart at 88.40$, which is within both dynamic and horizontal support. If the…

Continue Reading Brent Oil Technical Analysis, the price is approaching 0.618 FIB retracement

US Crude Oil Technical Analysis, the price reached the first target of the pullback

Technical analysis for Crude oil, the price reached the first target of the pullback on the monthly chart, the 0.618 FIB retracement at 88.00$. If the price of US oil breaks below the ascending trend line and below 88.00$, that will open the door for further declines toward the 1.272 FIB extension on the daily…

Continue Reading US Crude Oil Technical Analysis, the price reached the first target of the pullback

Silver Technical analysis, the price bounced from 0.618 FIB retracement

Technical analysis for Silver(XAG/USD), the price bounced from 0.618 FIB retracement on the monthly chart, and closed the month with a low-test candle pattern, starting a pullback. The first target for this pullback, the 0.382 FIB retracement on the daily chart at 19.82, was reached. The second target is the 0.618 FIB retracement on the…

Continue Reading Silver Technical analysis, the price bounced from 0.618 FIB retracement

Government Bond yields

10 Year Yield France Government Bond Technical Analysis for 2022

Technical analysis for the 10 Year Yield France Government Bond, the yield broke above the 2020 and 2021 high, accelerating the bullish movement of the weekly bullish wave. The first target for this bullish wave is the 1.272 FIB extension on the weekly chart at 0.735%. The second target is the 1.618 FIB extension at…

Continue Reading 10 Year Yield France Government Bond Technical Analysis for 2022

10-Year Yield UK Government Bond Technical Analysis for 2022

Technical analysis for the 10-year UK bond yield, the yield broke above the highs from 2020 and May 2021 and started a bullish wave on the weekly chart. The first target for this bullish wave is the 100% FIB extension at 1.340%. The second target for the bulls of 10-year UK bond yield is the…

Continue Reading 10-Year Yield UK Government Bond Technical Analysis for 2022

10-Year Yield German Government Bond Technical Analysis for 2022

Technical analysis for the German Government bond 10-year yield, on the weekly and the monthly chart, the 10-year German bond yield broke above the 2020 and May 2021 highs, starting a bullish wave. The first target of this bullish wave is the 0.618 FIB retracement on the monthly chart at 0.160%. The second target is…

Continue Reading 10-Year Yield German Government Bond Technical Analysis for 2022

10-Year Yield US Government Bond Technical Analysis for 2022

Technical analysis for the US Government bond 10-year yield, on the weekly chart, the price broke out above the double top, which was formed in October and November of 2021. The bullish breakout is a signal for the resumption of the third bullish wave on the weekly chart. The first target of this bullish wave…

Continue Reading 10-Year Yield US Government Bond Technical Analysis for 2022

Welcome

Hello there

We created Tradingchartanalysis.com with one mission in mind, to share our technical analyses so we can help your trading journey!

Learning how to trade the financial markets could be the most frustrating and difficult goal you had ever attempted! To successfully trade or invest in the financial markets, you need skills from all areas of life. Not only do you need to learn how to make technical analyses by reading candlesticks, chart patterns, and indicators, but you need to have specific psychology and mindset that allow you to follow the trading or investing strategies that you chose.

To accomplish that, you need to know thyself. That is why when you start your investing and trading journey, you are also on a journey of getting to know yourself better, without even realizing it!

With over eight years of experience in trading and analyzing the financial markets, we are happy to share our notes, knowledge, and technical analysis. Enjoy!

We are providing our technical analysis and fundamental notes for educational purposes only. If you attempt or use our analysis for trading or investing, you are doing that at your own risk! We are not responsible for any losses that may occur if you are using our analysis for trading or investing in the financial markets!

Contact us?

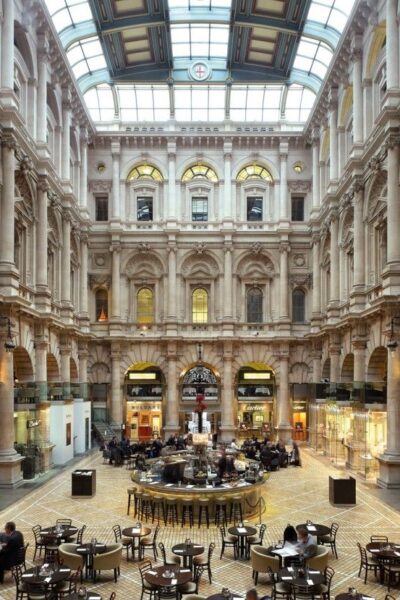

We look forward to meeting you!