Technical analysis for the FXMC dollar index is showing that on the weekly chart the index formed tweezers top a signal for potential resumption of the weekly bearish trend. The…

Read the post

trading

FXCM dollar index Technical Analysis, the index reached a key resistance zone

Technical analysis for the FXCM dollar index is showing that the price is still within the daily bullish run, but it reached a resistance around 11 910 – 11 915….

Read the post

Copper Technical analysis, consolidation for five weeks, and formed descending triangle on the daily chart

Technical analysis for Copper is showing, that after five weeks of consolidation the price formed descending triangle on the daily chart and the 4H chart. If the price breaks above…

Read the post

NVIDIA CORP (NVDA) Technical analysis, the shares broke above key resistance, a signal for resumption of the daily bullish trend

Technical analysis for NVIDIA CORP. (NVDA) is showing that the price reached the 5th target of the 3rd bullish monthly wave at 4.236 FIB extension around 580 and started a…

Read the post

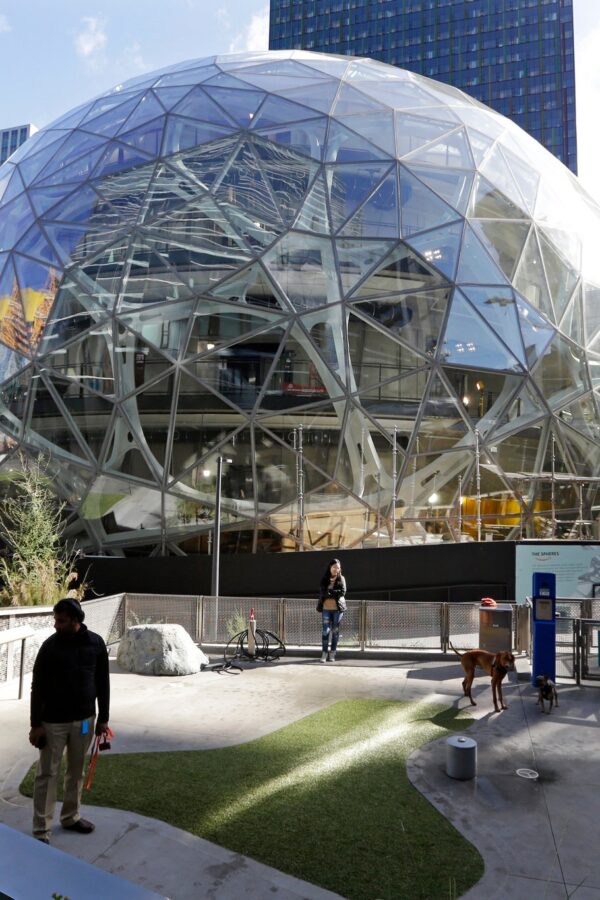

Amazon Com Inc. (AMZN) Technical analysis, the price formed a double bottom on the weekly chart after 6 months of consolidation

Technical analysis for Amazon Com Inc. (AMZN) is showing that the shares reached the 2nd target of the 5th monthly bullish wave at 1.272 FIB extension at $3555 and started…

Read the post

AMD Technical Analysis, the shares reached the 3rd target of the bullish monthly trend

Technical analysis for (AMD) Advanced Micro Devices is showing that the shares reached the 3rd target of their 5th monthly bullish wave at 1.272 FIB extension at 92$. The shares…

Read the post

Shanghai Composite index Technical analysis, the index formed a double bottom on the daily chart and tweezers bottom on the weekly chart

Technical analysis for Shanghai Composite Index is showing that the index reached 100% FIB extension of the last breakout on the daily and 4H chart around 3330 and formed a…

Read the post

The Easter week ahead will have its marks on the markets with lower volume and liquidity on Thursday and Friday

Expect low liquidity and low volume for this week, especially on Thursday and Friday before the Easter celebration around the world and ahead of the big weekend to kick start…

Read the post

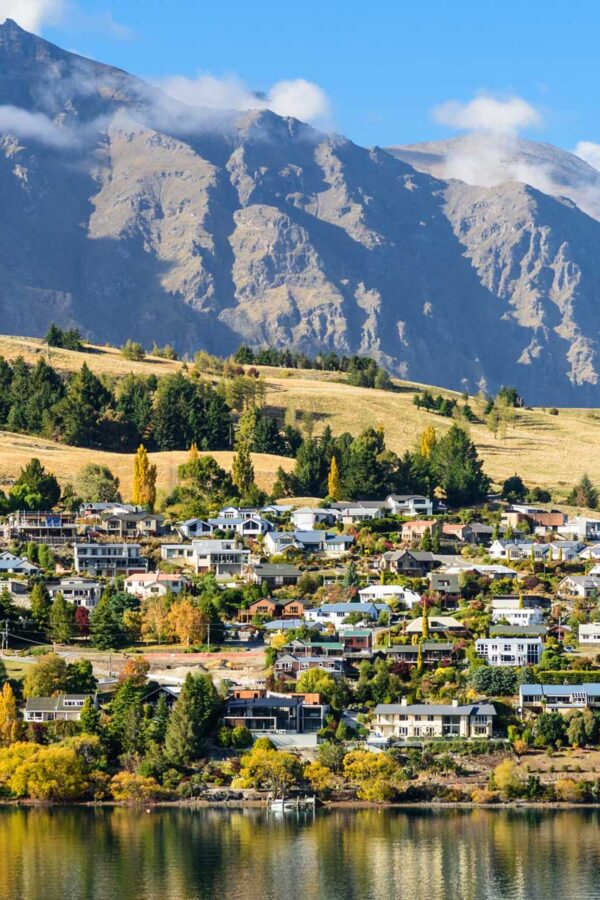

EUR/NZD Technical analysis, the pair broke out above descending price channel and previous high on the daily chart, a signal for further upside potential ahead

Technical analysis for the EUR/NZD is showing that the pair broke above descending price channel and previous high on the daily chart, signaling further upside potential ahead. The first target…

Read the post

Gold – Technical analysis, the price reached support and the second target of the daily bearish trend and bounced from it, starting a consolidation

Technical analysis for Gold is showing that the price reached support, 0.618 FIB retracement and the second target of the daily bearish trend at 1670 and bounced from it. Now…

Read the post

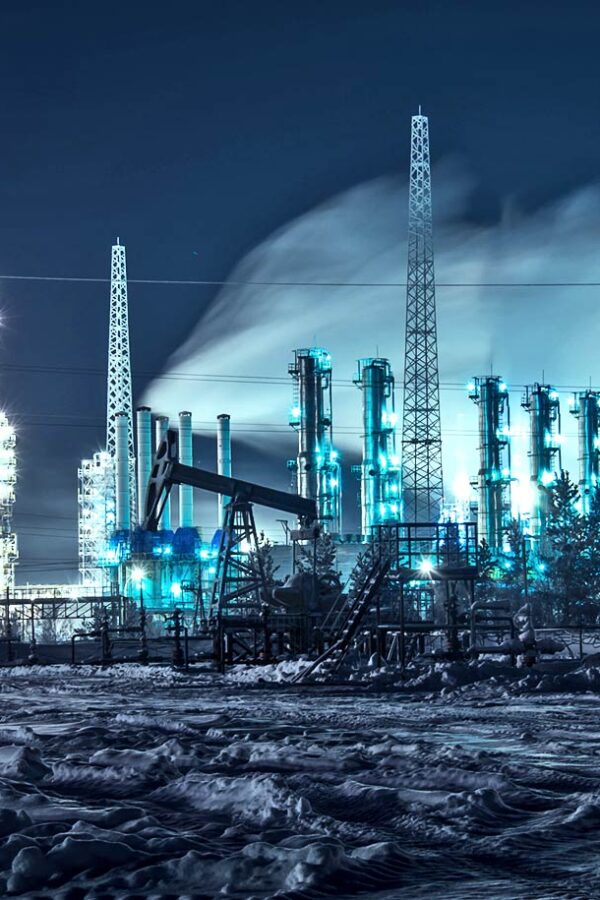

US Oil Technical analysis, the price retested previously broken trend line and closed with a low-test candle on the weekly chart ahead of the OPEC meeting

Technical analysis for Crude Oil is showing that after the initial leg down, the price bounced from the previously broken trend line, which now is a support on the weekly chart…

Read the post

UK Oil Technical analysis, the price bounced from ascending trend line on the daily chart and is consolidating in a range ahead of the OPEC meeting

Technical analysis for Brent Crude Oil is showing that after the initial leg down, the price bounced from support on the daily chart at ascending trend line and 0.618 FIB…

Read the post