|

Getting your Trinity Audio player ready...

|

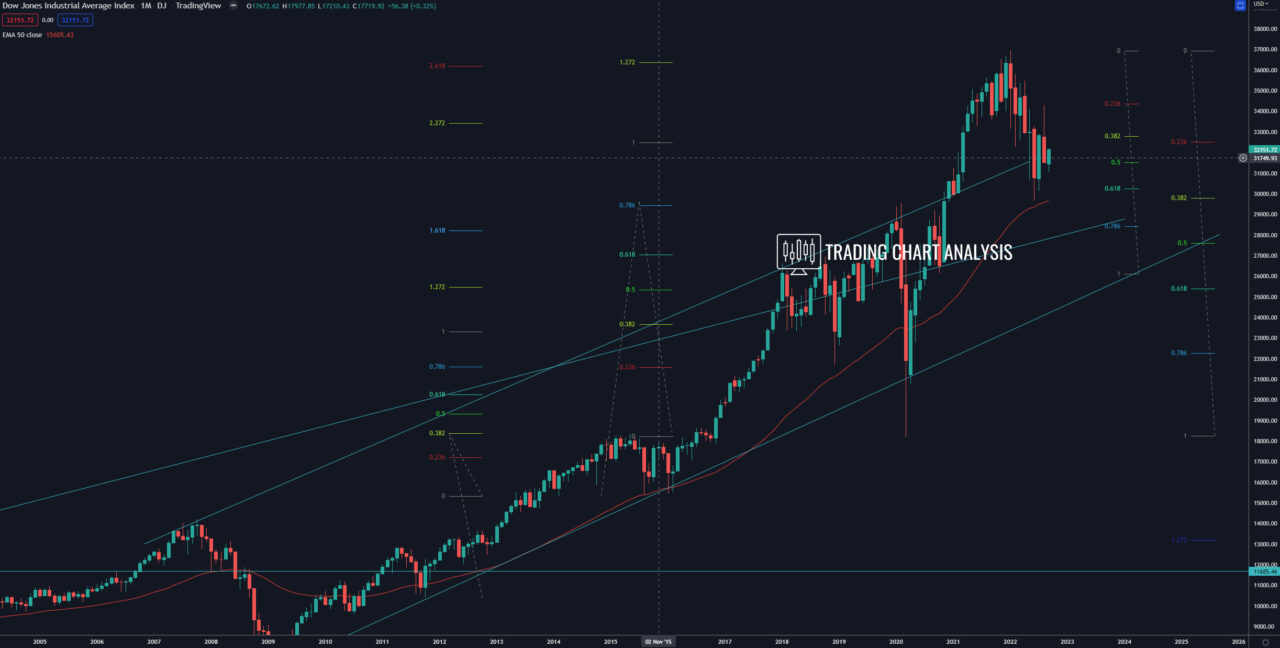

Technical analysis for Dow Jones Industrial, the index rejected the 0.618 FIB retracement at 34 180 on the weekly and monthly charts, resuming the bearish trend. The focus now is on the low from last week at 31 048, a break below it will send the index lower to retest the previous low on the weekly chart at 29 653.

If the Dow Jones index breaks below the previous low at 29 653, that will extend the bearish wave and send the index lower. The first target for this potential bearish development is the 2.272 FIB extension on the weekly chart at 27 180. The second target is the 0.618 FIB retracement on the monthly chart at 25 415, just above it, we have the 2.618 FIB extension on the weekly chart at 25 860.

On the other hand, the Dow Jones index managed to hold the 0.618 FIB retracement at 31420 on the weekly chart and bounce from it. The first target for this bounce is the 0.382 FIB retracement at 32 280. The second target is the zone between 0.618 FIB retracement and the resistance between 33 050 – 33 360. The fourth target the Dow Jones index is the previous high on the weekly chart at 34 281.

Daily chart:

Weekly chart:

Monthly chart: