|

Getting your Trinity Audio player ready...

|

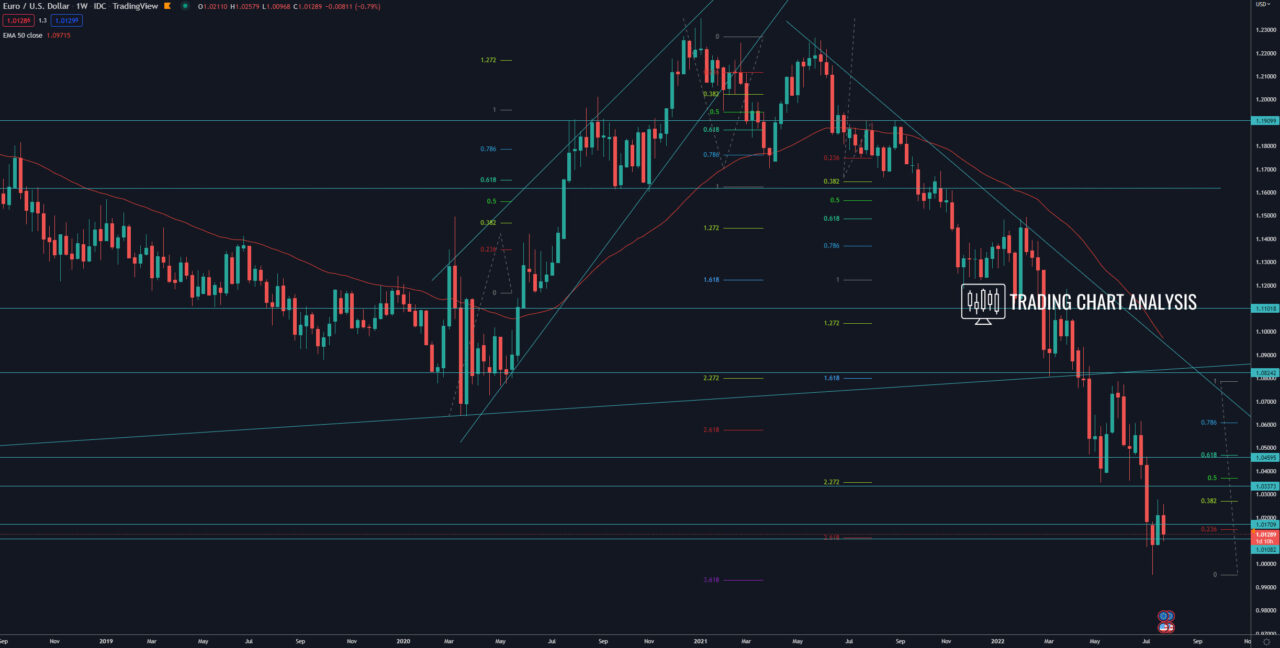

Technical analysis for EUR/USD, the pullback which started with the morning star pattern on the weekly chart reached the first target, the 0.382 FIB retracement at 1.0270. The focus now is on the 0.618 FIB retracement on the daily chart at 1.0075, a breaks below it will send the pair lower. The first target for such a bearish development for the EUR/USD is the 1.272 FIB extension on the four-hour chart at 1.000. The second target is the 1.618 FIB extension at 0.9930, where is the 1.618 FIB extension for the last bearish swing on the daily chart.

On the other hand, if the EUR/USD breaks above 1.0270, that will send the pair higher. The first target for such a bullish development is 0.618 FIB retracement on the daily chart at 1.0335, which is strong resistance and where is the daily 50 EMA. The second target for this bullish scenario in the EUR/USD is the 0.618 FIB retracement on the weekly chart at 1.0470. The third target is the 0.382 FIB retracement on the monthly chart at 1.0540, and the fourth target is the high on the daily chart around 1.0610.

Looking at the bigger picture for the EUR/USD, the pair broke below the low at 1.0340. This breakout resumed the bearish wave on the monthly chart. The second target for this bearish wave is the 1.618 FIB extension on the monthly chart at 0.9150.

Daily chart:

Weekly chart:

Monthly chart: