|

Getting your Trinity Audio player ready...

|

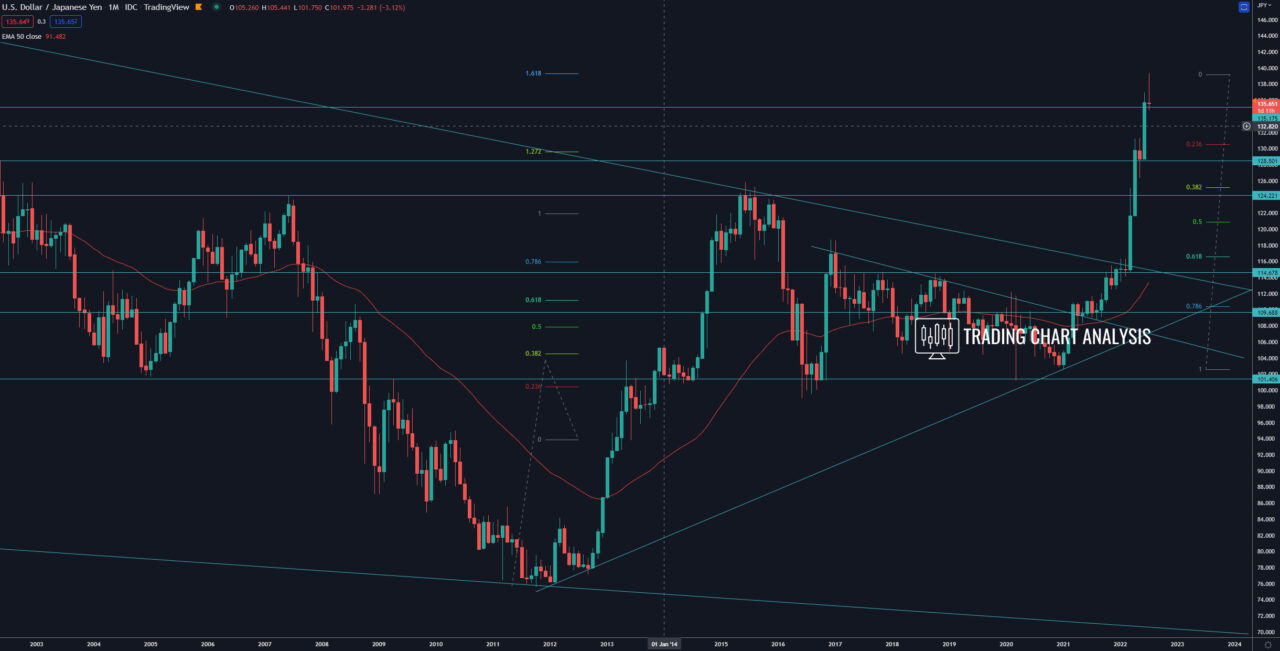

Technical analysis for USD/JPY, the pair reached the second target of the bullish wave on the monthly chart, the 1.618 FIB extension at 139.35, and rejected it. The rejection manifested with a bearish engulfing pattern on the weekly chart and a break below an ascending wedge on the daily chart. This price action started a pullback for the USD/JPY on the weekly chart and a bearish run on the daily chart. The first target for the pullback is the 0.382 FIB retracement on the weekly chart at 134.40, where is the 0.618 FIB retracement on the daily chart and the daily 50 EMA.

The second target is the 0.618 FIB retracement on the weekly chart and the 1.618 FIB extension on the daily chart around 131.25.

The focus now is on the resistance zone between 137.50-75, if the USD/JPY close above it on the daily chart, that will open the door for a bullish run toward the previous high at 139.39.

Daily chart:

Weekly chart:

Monthly chart: