|

Getting your Trinity Audio player ready...

|

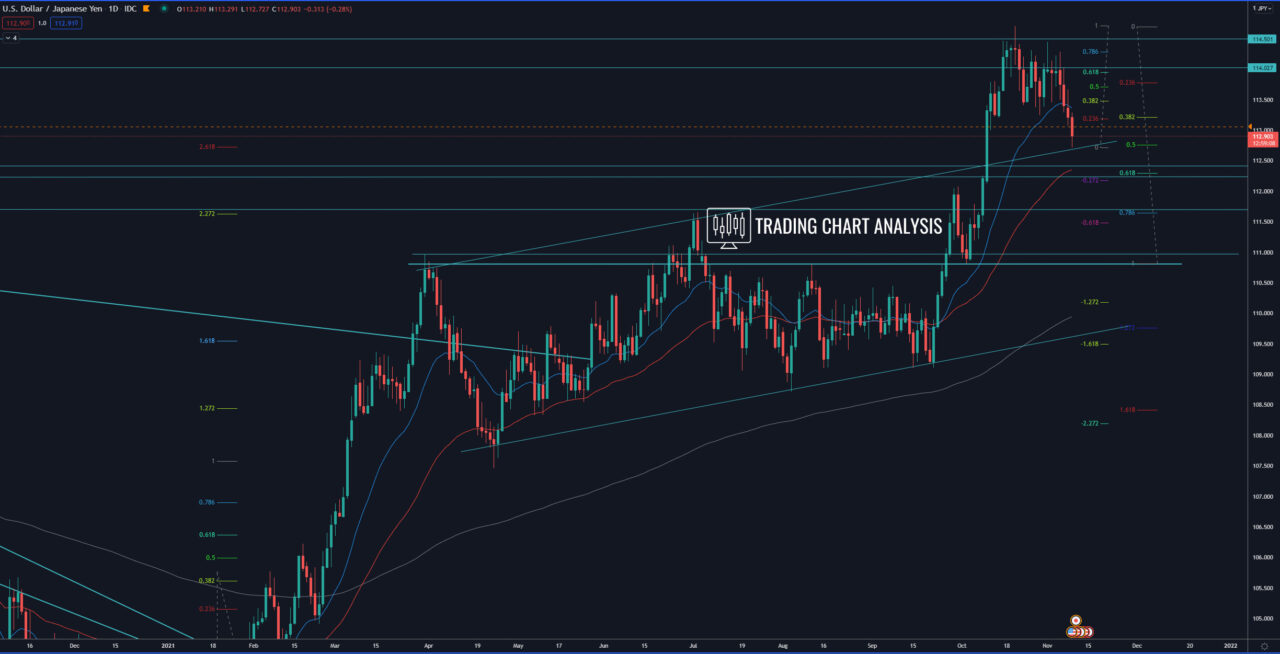

Technical analysis for the USD/JPY, the pair rejected resistance zone between 114.10-114.70 and started a consolidation. Looking at the daily chart, the USD/JPY breaks out of consolidation and extends the daily pullback. The first target of this pullback is the 0.386 FIB retracement on the weekly chart at 112.55. The second target is the 0.618 FIB retracement on the daily chart and the daily 50 EMA at 112.30, which is a support zone, from where the price may resume the bullish trend. The third target is the 1.618 FIB extension on the four-hour chart at 112.15. If the USD/JPY pair breaks below 112.15, that will open the door for a further decline toward the 2.272 FIB extension at 111.30 and second tard the 2.618 FIB extension at 110.85.

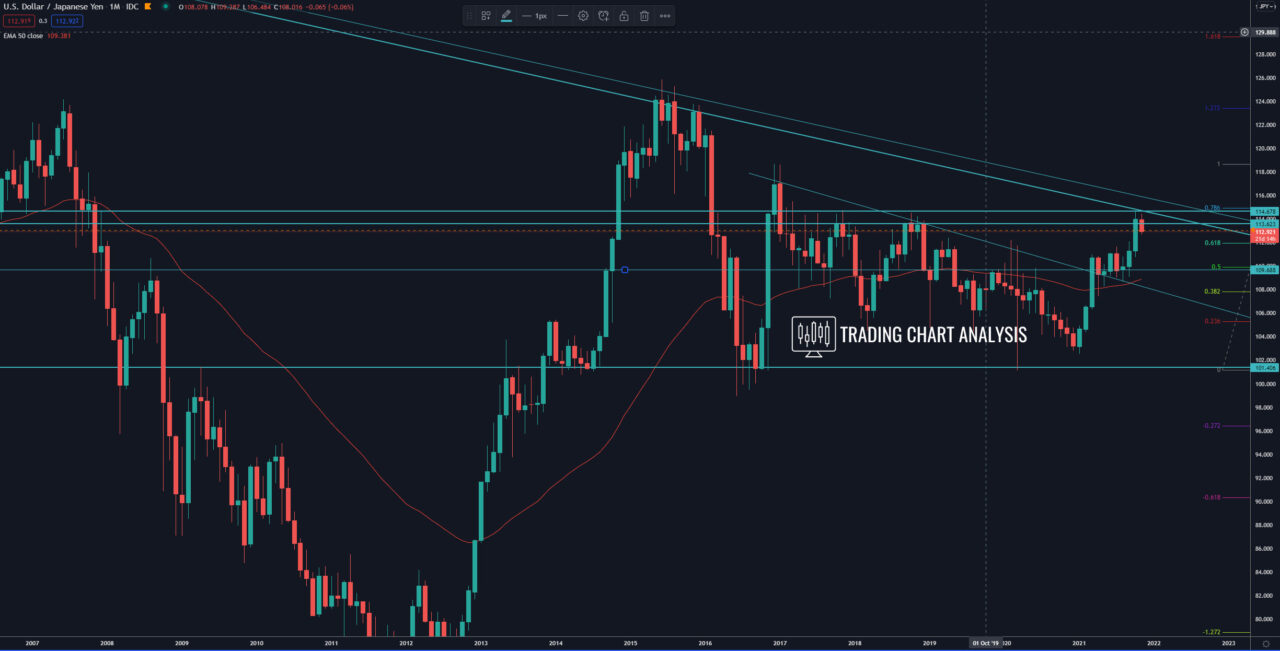

Looking at the monthly chart for the USD/JPY, the resistance zone between 114.10-114.70 is a key resistance zone, where we have descending trend line. Breaks about that key resistance zone will open the door for a bullish run toward, first the high at 118.50, second the resistance at 121.70, and eventually 125.50.

Daily chart:

Weekly chart:

Monthly chart: