|

Getting your Trinity Audio player ready...

|

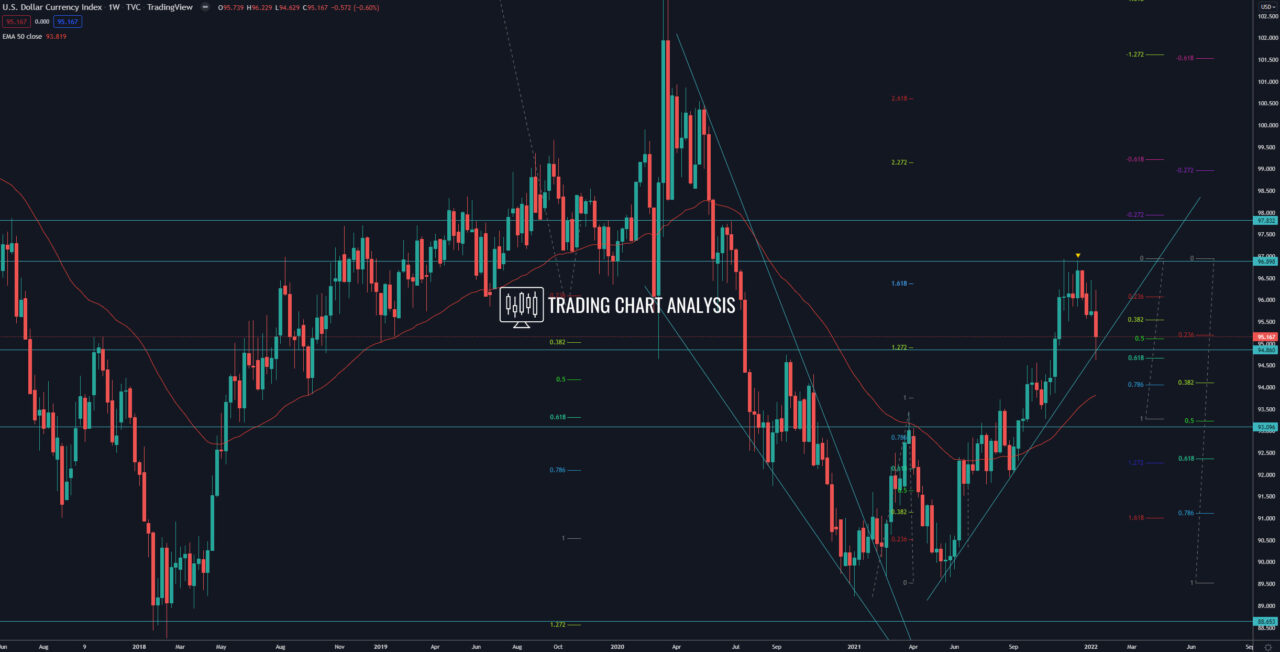

Technical analysis for the DXY dollar index, the index reached the 0.618 FIB retracement and horizontal and dynamic support on the weekly chart. If the index breaks below the ascending trend line on the weekly chart and below the low at 94.62, that will be a signal for further declines. The first target for the potential breakdown is the 0.382 FIB retracement on the weekly chart at 94.10. The second target for the weekly pullback of the DXY dollar index is the low on the weekly chart at 93.27.

On the monthly chart, the DXY dollar index broke above the high at 94.74 and the 0.382 FIB retracement. This breakout opened the door for a bullish run toward the 0.618 FIB retracement on the monthly chart at 97.75. Therefore, if the price break above the daily high at 96.46, that will be an early signal for resumption of the bullish trend.

Weekly chart:

Monthly chart: