|

Getting your Trinity Audio player ready...

|

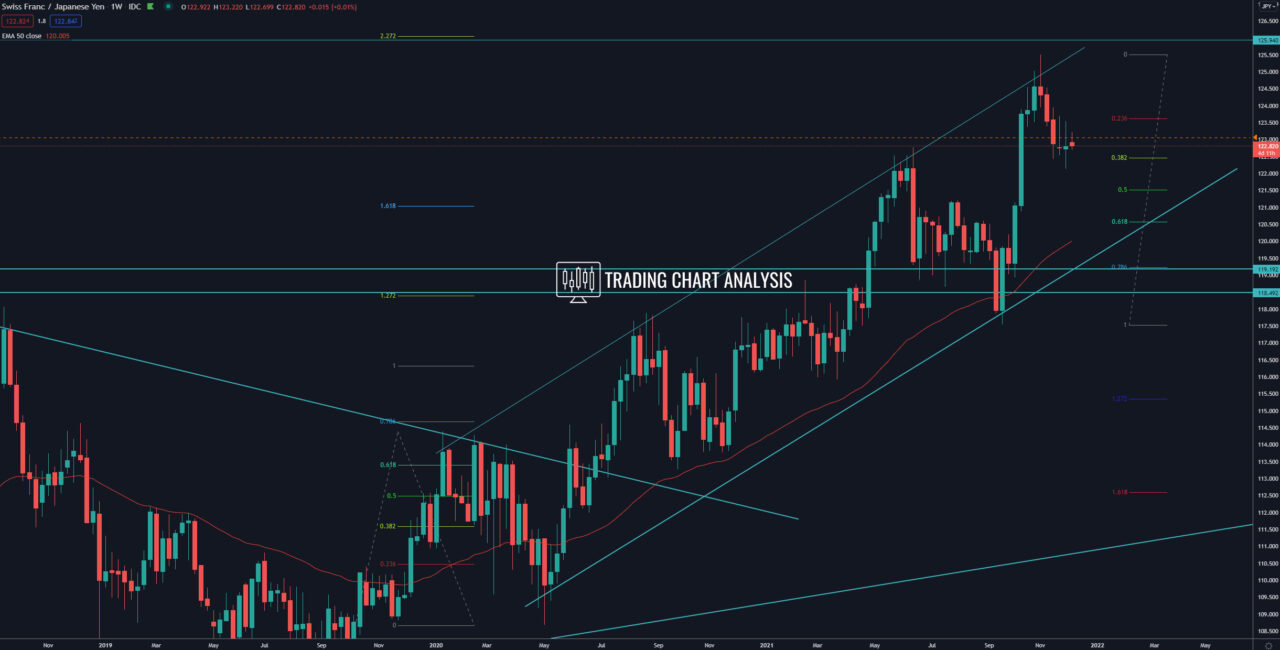

Technical analysis for the CHF/JPY, the price broke below the previous daily low at 123.42 and started consolidation. The consolidation formed a range between 123.55-122.14. If the CHF/JPY pair breaks below the low at 122.14 and below the 0.386 FIB retracement on the weekly chart at 122.45, it will open the door for a bearish run. The first target of this potential breakout is the 1.618 FIB extension on the four-hour chart at 121.0. The second target for this break is the 0.618 FIB retracement on the weekly chart at 120.55.

On the other hand, if the price breaks above the range and the high at 123.71, it will resume the bullish weekly trend and send the CHF/JPY higher. The first target for this potential bullish breakout is the 0.618 FIB retracement on the daily chart at 124.20. The second target is the previous high at 125.51.

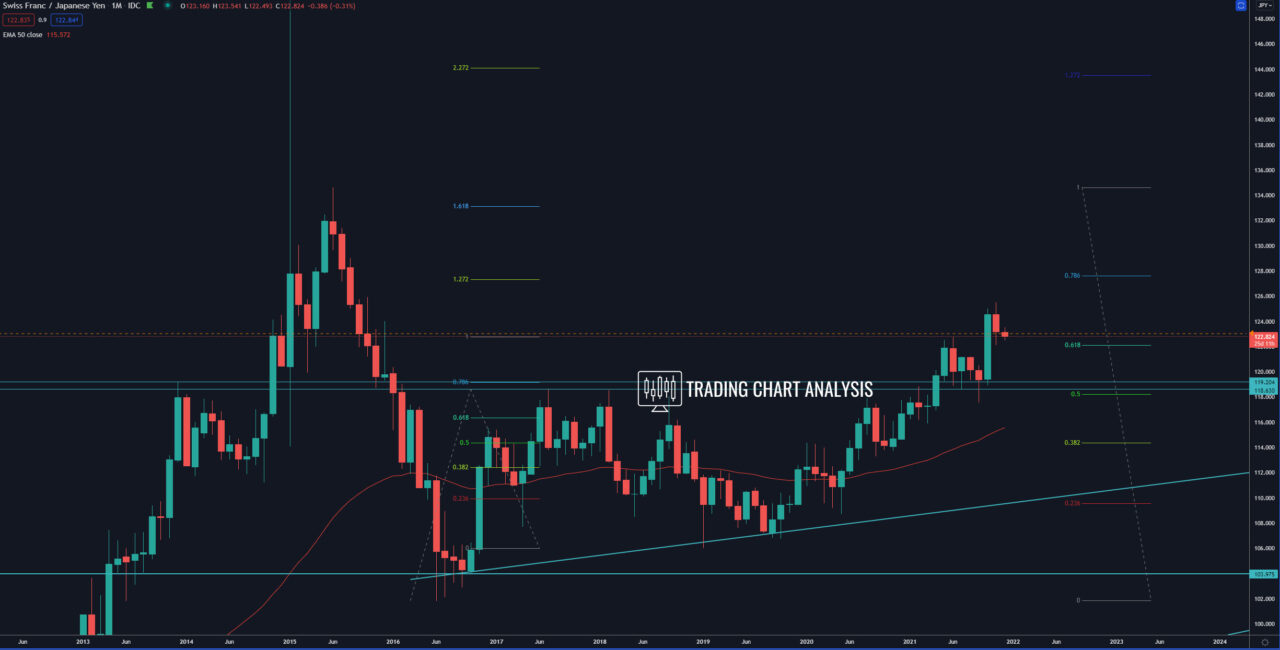

Looking at the bigger picture on the monthly chart, the CHF/JPY pair broke above the 2017 and 2018 high at 118.60. The first target for this breakout is the 0.618 FIB retracement at 122.10, which was hit. The second target is the 1.272 FIB extension and 0.786 FIB retracement on the monthly chart at 127.30. But before that, we need to see a sustainable break above the weekly high at 125.51.

Daily chart:

Weekly chart:

Monthly chart: