|

Getting your Trinity Audio player ready...

|

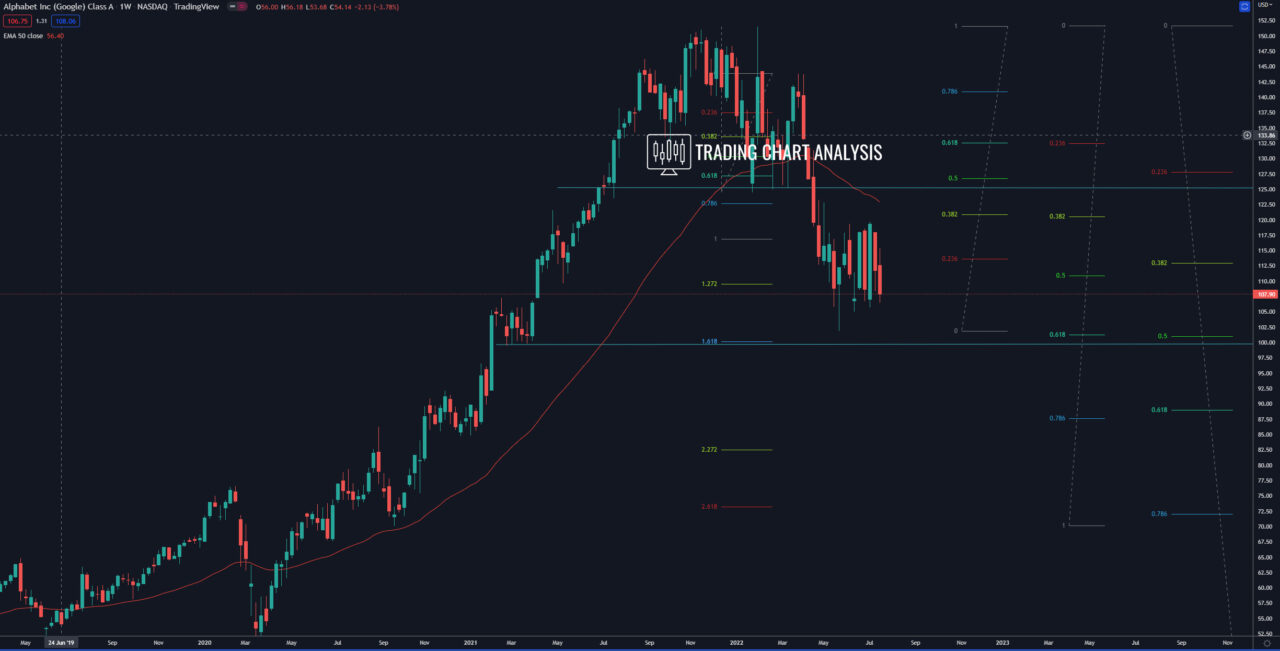

Technical analysis for Alphabet, after the break below the support at 125.50 in April 2022, the shares of Google started a bearish run. The first target of the bearish run, the 0.618 FIB retracement on the weekly chart around 101.00, was reached. The shares of Alphabet/Google went as low as 101.88 and started a consolidation. Just below the consolidation zone, between 100.00 – 101.00, is the 0.500 FIB retracement on the monthly chart and the 1.618 FIB extension on the weekly chart. Therefore, the 100.00$ level is a key level for Alphabet/’Google, a break below that price will send the shares lower. The first target for such a bearish development is the 0.618 FIB retracement on the monthly chart at 89.00-90.00$. The second target is the 2.272 FIB extension on the weekly chart at 82.50$. The third target for this bearish scenario for the shares of Alphabet is the 2.618 FIB extension on the weekly chart at 73.25$.

On the other hand, a break above the consolidation, above the weekly and the daily 50 EMAs, and above the 0.382 FIB retracement and resistance zone at 125.00$, will push the shares of Alphabet(Google) higher. The first target for this bullish scenario is the 0.618 FIB retracement on the weekly chart around 132.500-133.00$. The second target is the high on the weekly chart at 143.79$. The third target is the previous all-time high of 151.55$.

Weekly chart:

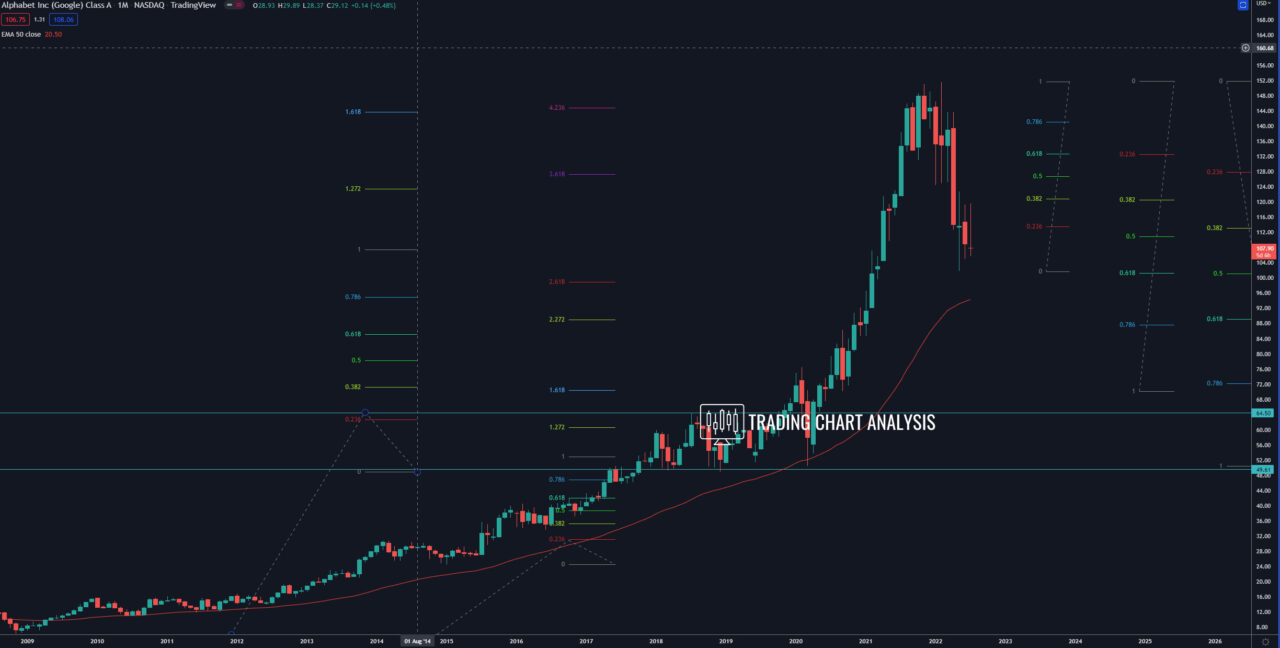

Monthly chart: