|

Getting your Trinity Audio player ready...

|

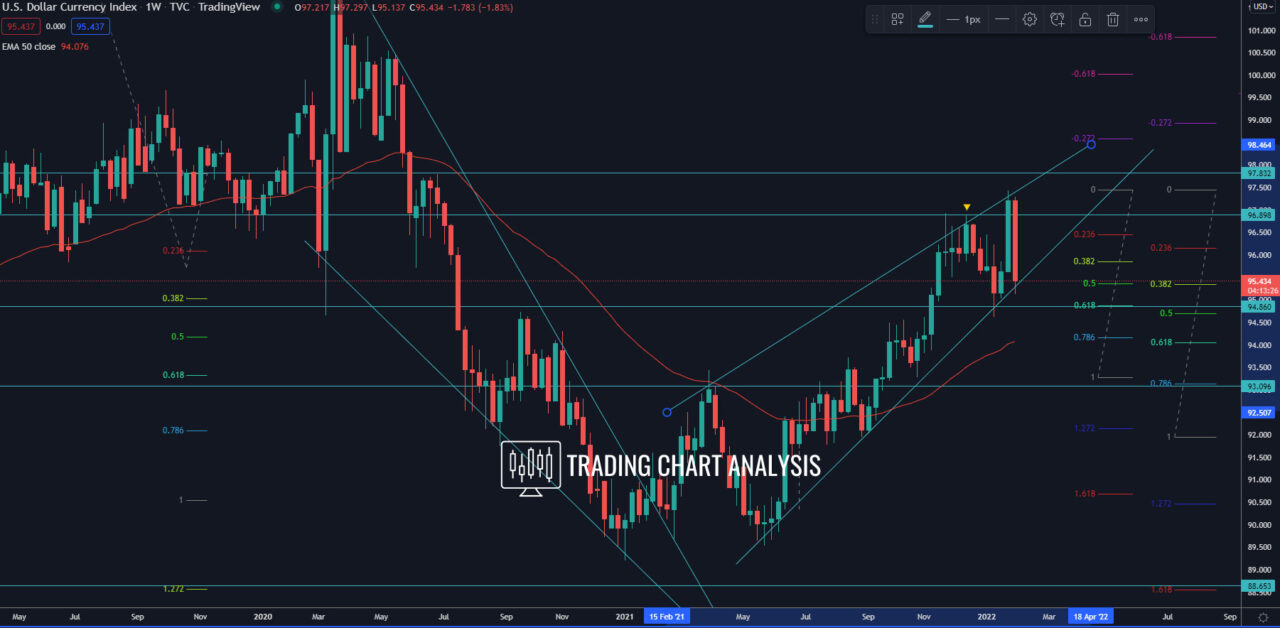

Technical analysis for the DXY index, the dollar index closed the week with a bearish engulfing candle, starting a pullback. The first target for this pullback, the 0.382 FIB retracement on the weekly chart at 95.85, was reached. The DXY dollar index went as low as 95.15 and bounced from ascending trend line and support. If the index break below last week’s low at 95.15, it will send the index lower toward the low at 94.62.

Looking at the bigger picture, on the monthly chart, the DXY dollar index broke above the high at 94.74, formed in September 2020. This bullish break opened the door for a bullish run toward the 0.618 FIB retracement at 97.75. The DXY dollar index is on its way toward that target.

Weekly chart:

Monthly chart: