The data releases from the last week were encouraging, pointing to perhaps the beginning of a robust economic recovery not only in the USA but in Europe as well.

The US Non-Farm Payrolls for March was very strong, came out at 916K vs. an expectation for 680K and the previous month at 468K. Significantly, the gains are coming from the private sector, Nonfarm Payrolls Private for March came out at 780K vs. an expectation for 455K, and the previous month was at 558K.

In the week ahead, the market participants will watch the FOMC Meeting Minutes on Wednesday and Fed Chair Powell Speech on Thursday. We know the FED message, they are committed to no interest rates hike until at least 2023. However, one must wonder what the FED will say about QE tapering after three more months of 900K+ job increase.

Last week the Biden administration released more details about their $2.3-trillion infrastructure plan. We don’t know how this plan will pass through Congress since the Republicans already declare that they will fight against it with everything they have. Either way, these types of proposals are boosting business confidence and are overall positive helpful for the recovery of the US economy.

It is not all good, more stimulus means an increase in the US debt, increase in the US debt means potentially higher taxes in the future.

Still, looking at the recent economic data, there are shreds of evidence for solid economic recovery and growth, especially with the winter behind us and the reopening in the UK, later in Europe, and a rapid COV19 vaccination in the USA. All this is pointing to a robust economy for the rest of 2021.

The growth in the manufacturing sector has been the star of this economic recovery and helped to lift the stock markets higher last week.

Please review our latest technical analysis for NASDAQ, Shanghai composite index, AMD, NVIDIA, and Amazon, all pointing to potential breakouts.

The OPEC+ meeting last week came out with a decision to increase the oil production starting from May with an increase of 350,000 barrels per day (BPD). Both the Brent Crude and the Crude Oil continue trading in the range established in the previous week.

In the week ahead, the markets will be focused on the FOMC Meeting Minutes on Wednesday and Fed Chair Powell Speech on Thursday. Also, the latest Service PMIs data from the EU, UK, and the US, are we going to see a pick up in the lacking Services sector.

The Reserve Bank of Australia RBA interest statement on Tuesday will be closely watched as well.

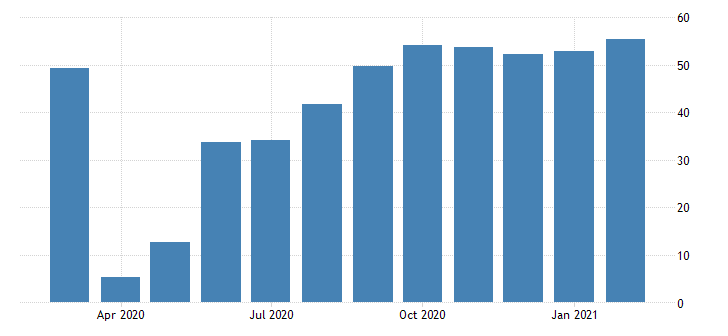

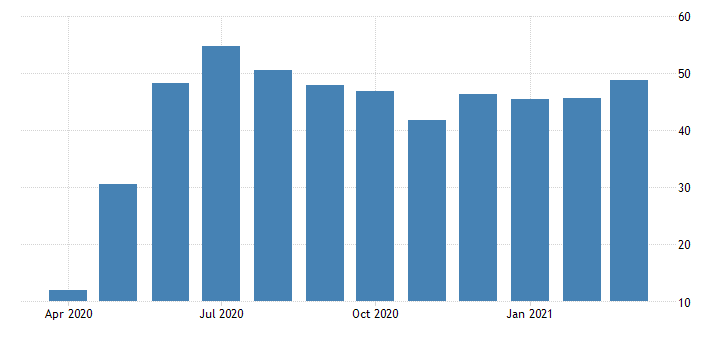

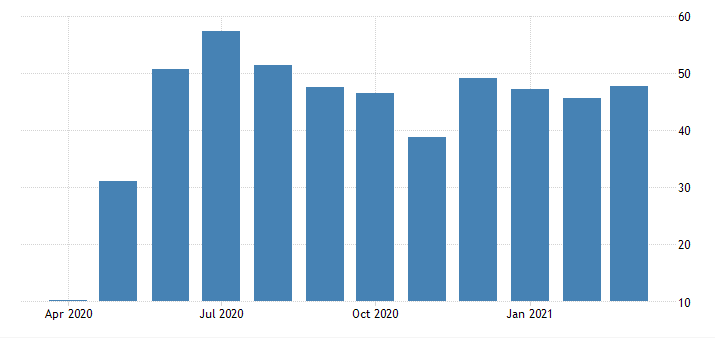

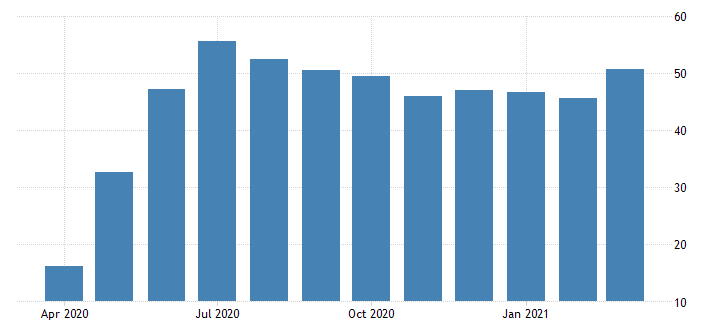

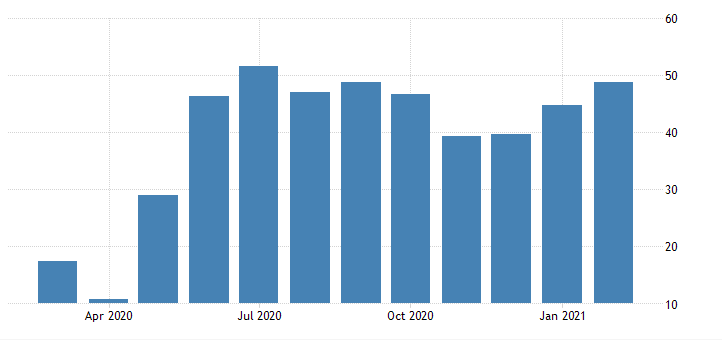

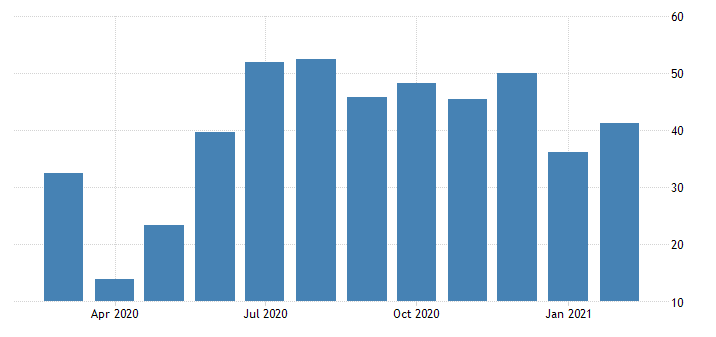

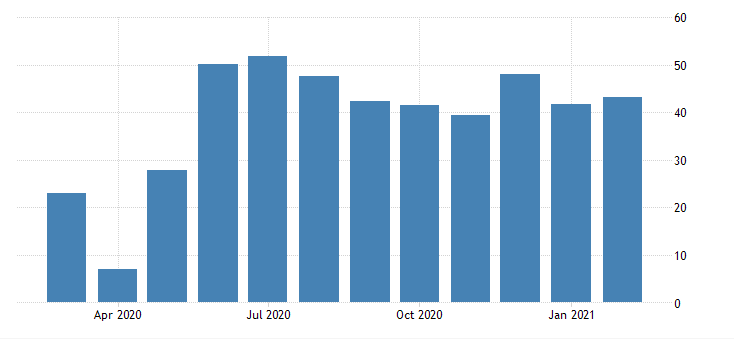

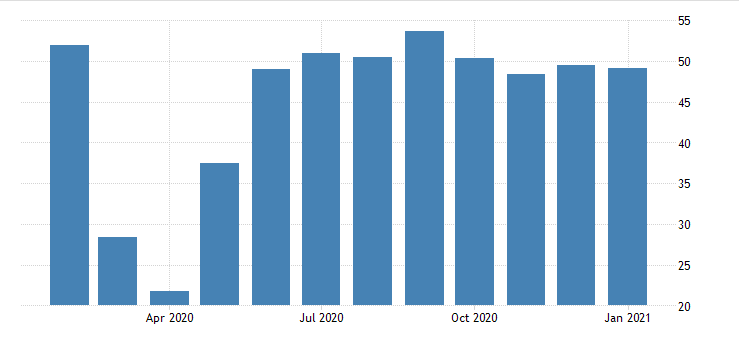

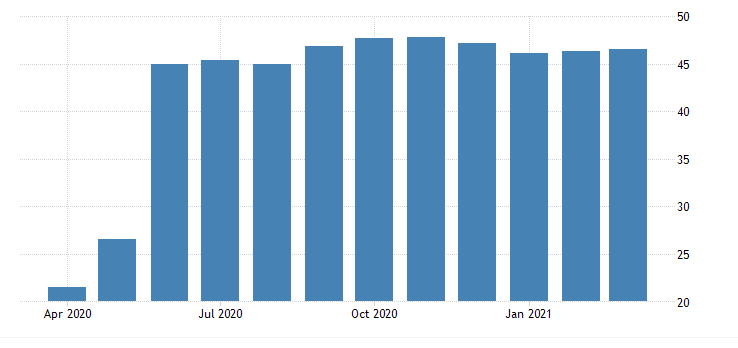

Here are the details for the previous Service PMIs:

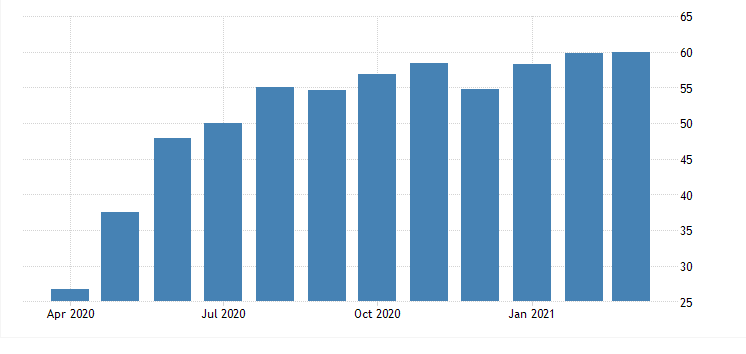

Australia Performance Services Index:

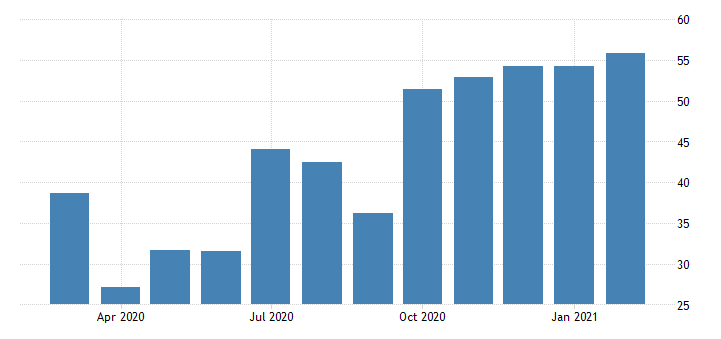

New Zealand Services PMI:

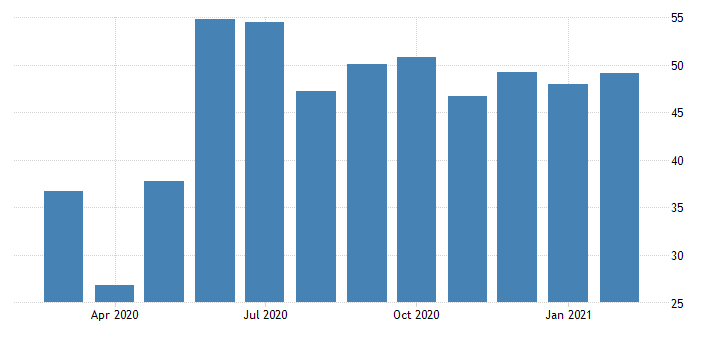

China Services PMI:

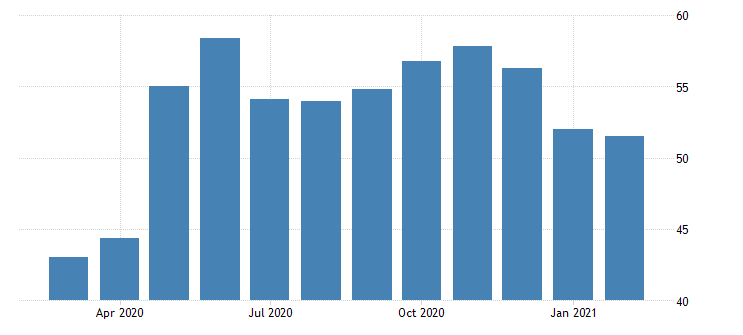

India Services PMI:

Euro Area Services PMI:

France Services PMI:

Germany Services PMI:

Italy Services PMI:

Ireland Services PMI:

Spain Services PMI:

Switzerland Services PMI:

Japan Services PMI:

US Services PMI: